Services Tailored to Your Needs

Financial Consultations

A Financial Needs Analysis (FNA) is a complimentary service that shows you where you are financially, what you are doing well, and where you could use help. This is the first step to achieving your definition of wealth.

Make sure you have your financial "ducks in a row"

Uncover or discuss your financial goals

Create a tailored plan to take action to achieve your goals

Family/Income Protection

Based on your Financial Needs Analysis, we may find that your family and/or personal income needs protection, otherwise known as insurance. Insurance strategies will ensure that your household is protected against life's unexpected events.

Term life insurance

Whole life insurance

More...

Investing

We offer 2 main ways to invest: (1) Wealth Building and (2) Cashflow-planning

Wealth Building Strategies get you set up with registered account and investment vehicles to systematically build your wealth over time in a way that fits your personal goals. These products are great for families earlier in life.

Cash Flow Planning is typically best for those of you who are closer to retirement or have experienced a life event (like selling a business) that requires you to look at how the next chapter of your life will be funded.

Confidence that you’re working towards your wealth goals

No more money anxiety keeping you up at night. We’ll cut through confusing financial terms and concepts, making sure that you understand and feel empowered in your financial decisions.

A tailored financial plan made just for you and your family

We’ll work through what wealth means to you and show you steps that can be taken to get you there. We understand your definition of wealth is unique, and so should your plan.

On-going support to adapt to the changes in your life

We’re here to support you over the long term. As your life changes, so do your financial needs.

Secure your financial future.

Click below to book your FREE consultation.

Meet Our Team

Cody Boekestyn,

Financial Advisor

Ayla De Grandpré, Communications & Marketing Specialist

"Working with Cody has been nothing short of fantastic. He's down to earth, knowledgeable, and explains concepts in a way that I can understand. Unlike previous experiences with financial advisors, I can genuinely say I feel more comfortable and confident in my retirement future ever since I started working with him..."

- Mark, Obsidian Financial Client

Our Location and Where We Work with our Clients

We’re currently situated in the beautiful city of Kelowna, British Columbia. We work with people like you who live in British Columbia, and Ontario, Canada. Most of our appointments take place virtually, however we may be able to meet with you in person if you live in the Kelowna area.

Our Blog

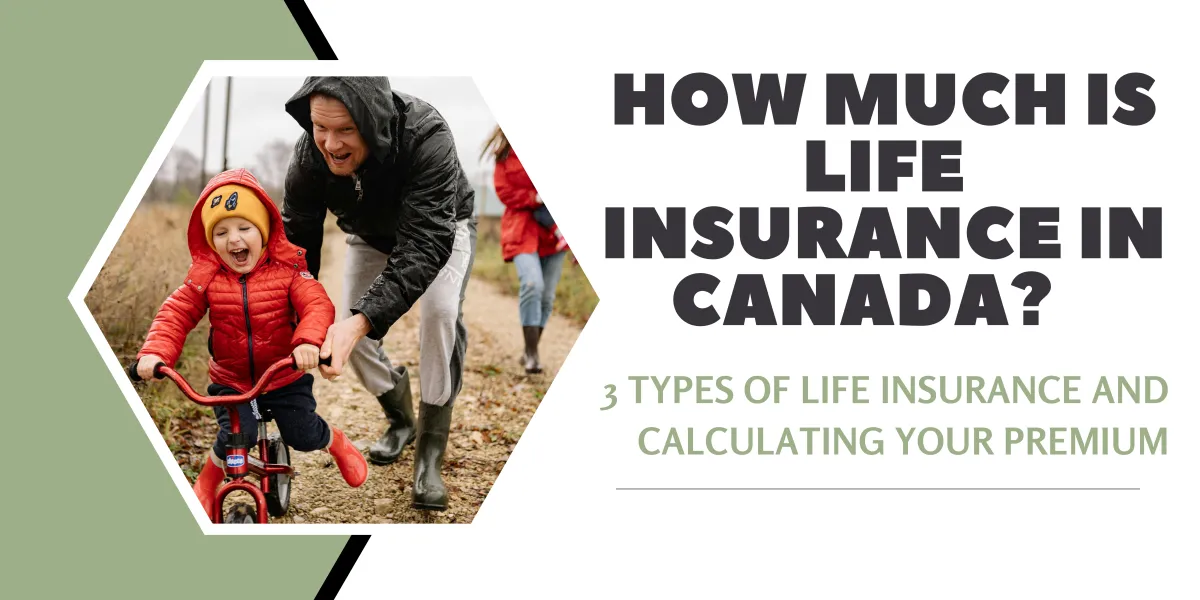

How Much Does Life Insurance Cost in Canada?

“It’s only the cost of a cup of coffee an hour - Michael Scott”

Ever tried searching "how much is life insurance?" only to tumble into a rabbit hole of confusing information, leading you to a form demanding your details for a "free quote"? Most of us simply want a ballpark figure of life insurance costs without the hassle of relentless cold calls and (shudders) high-pressure sales tactics.

Have you ever wondered why figuring out how much life insurance costs feels like asking your angsty teenage daughter to tell you how her day was? In conversations with life insurance agents, the price tag might be the last thing they want to talk about, with a lot of "beating around the bush" that leaves you frustrated.

The truth is, most insurance agents and providers hesitate to disclose upfront costs. There are understandable reasons behind this - Often, they can’t provide a definitive cost without a formal application and risk assessment by an underwriter. But we believe in being as transparent as possible, and that you deserve an answer to this question. This article aims to provide clarity and transparency, addressing your main question: “How much does life insurance cost?”

Before you read on, if you just want to see how much life insurance is going to cost for you, head here.

In this article, we’ll:

Unpack 2 types of life insurance

Delve into the factors influencing your rates

And offer a glimpse into the potential costs - math lecture not included, promise.

Just like the wise meme once told us: “the meeting could have been an email,” we hope to satisfy your initial curiosity about life insurance costs with this straightforward blog post.

Disclaimer: This blog is not intended to serve as financial advice, but rather provides some general guidance on how life insurance costs are calculated. Seek guidance from a licensed financial advisor before making any financial decisions.

Before you read on:

Curious about why thinking about life insurance and your death might make your life better? Read more here.

Don’t know if you even need life insurance? Find out if you have an insurable interest here.

Types of insurance

Before we talk money, we should probably clarify a few terms to make sure we're on the same page...

Underwritten insurance

You can think of underwritten insurance like the VIP box seats at your favourite sports venue. You’re required to complete a screening process, which may include an interview, and a physician’s statement, vitals and medical exams. Once you’re past the velvet rope though, you’re in. You know you have coverage, and that your loved ones are protected. The primary reason a claim might be denied is if the insurer proves that you were dishonest (fraudulent) on your application.

Simplified Issue Insurance

This is the express lane of life insurance: it’s quick and there are limited health checks involved, which makes it a good option for those of us who want quick and easy coverage, or have had medical complications in the past preventing them from fully underwritten policies. The drawbacks are that it tends to be more expensive, and the coverage amount can be limited as insurers don't know your health history.

Term-20 Insurance

If insurance was a car, term 20 would be a toyota corolla. Term-20 insurance provides a sense of comfort and security for you and your family. Term-20 is one of the most popular life insurance options for protecting your income and mortgage, so that your family doesn’t experience lifestyle decline should you die (More on this in our article “Do I have an Insurable Interest?”). Most life insurance providers will offer Term-20. With Term-20, your premiums are set for two decades, providing long-term coverage. If anything happens within those 20 years, your beneficiaries receive a guaranteed sum.

Phew, that's done.

So... How much is life insurance cost anyway?

How Life Insurance Companies are Calculating your Premiums

Understanding the cost of your life insurance involves several key factors: Age, gender at birth, smoking status, and medical history/status.

In this section, we've outlined typical annual rates for a $500,000 Term-20 life insurance policy for two different profiles.

Before we get into costs, a couple of details to note: First, life insurance companies often add a policy fee, generally $50-100 for the policy. Second, paying annually can save you about 8% compared to monthly payments due to lessened risk assessment by the insurance company over time. This is because if you’re paying monthly, you’re going to be 11 months older by the last monthly payment, which increases your risk to the insurance company.

Now let’s get on to the reason you’re reading this article in the first place…

In the graphs below, you’ll see approximate life-insurance costs for a Term-20 policy for a male and a female applicant, based on the age when they apply for life insurance (x-axis, along the bottom) and smoking status (blue is the rate for non-smokers and orange is for smokers).

As you can see in these charts, your age at the time of application and factors such as smoking status are two of the most influential factors that determine your cost.

Age and Smoking Status

For instance, if you are a male applying for life insurance at 30 you may be paying $30.42/month or $338/year, whereas a 50 year old male applicant may pay $131.40/month or $1460/year.

That same 30 year male will also pay more if they are or have been a smoker: they would pay approximately $69.30/month in this scenario. With most life insurance carriers, you can apply for non-smoking status once you’ve quit for 1-2 years.

Sex Assigned at Birth

Sex assigned at birth is another important factor. In the charts above, if you look at the Y-axis (vertical axis), which shows the monthly amount, you’ll see that the males chart goes much higher in cost than the females chart ($1200 at the top range for males vs. $700 for females). To illustrate further, a 40-year non-smoking old male may pay $508/year or 45.72/month, while a 40-year old non-smoking female may pay $378/ year or 34.02/month. The conventional knowledge guiding this difference is that females statistically have a longer life expectancy and lower mortality rates.

Okay, we’re done the numbers part…

Click here if you want to see how much life insurance might cost for you or your loved one.

Bottom Line: Life Insurance is a Game of Risk

This is by no means a complete guide to how much you will pay for life insurance, but it does provide a general guideline for you to gauge your risk factors and get a general idea of what life insurance might cost for you.

Life insurance is a game of risk for insurers. The higher the likelihood of your untimely departure, the heftier your premium. In simpler words, the closer you are to the grand exit, the pricier your ticket. Imagine a centenarian applying for $100,000 of life insurance. The premium would likely be $100,000, since insurers assume a persons lifespan will be 100 years. Death is life's ultimate certainty in the end. The role of insurance companies is to determine how close you are statistically to that certainty, and to provide you peace of mind should your time come sooner.

Get started with us for free, today.

Want to keep in touch?

Sign up to receive our monthly newsletter to receive news and updates.

Monthly newsletters include exciting updates and links to new informative blog content and education.